Capacity output of the economy is considered to be the amount of goods and services that can be produced without demand. That could lead to less economic output and a lower rate of GDP.

The Relationship Between Inflation And Unemployment Boundless Economics

Fifteen-year fixed-rate mortgages averaged 417 percent this week up from 391 percent last week and 235 percent a year ago.

. The inflation rate is decreasing and unemployment is rising. When unemployment rises the inflation rate will possible to fall. Economic growth inflation and unemploy ment ar e the big macroeconomic issues of our.

The economy is likely in a. Before the 1970s classical economists stated that an inverse relationship existed between the inflation rate and the unemployment rate. If levels of unemployment decrease inflation increases.

Explain how the Federal Reserve may use the discount rate and the reserve requirement to increase the money supply. A recession is a decline in total output unemployment rises and inflation falls. The inflation rate is increasing and unemployment is decreasing.

Answered Aug 22 2019 by Lorena. More questions like this When performing auscultation of the heart sounds what does S1 signify. The Phillips curve argues that unemployment and inflation are inversely related.

A trough 2 See. The economy is likely in. False A rising GDP declining unemployment rate and decreasing inflation would signify a healthy economy.

In general higher interest rates are a policy response to rising inflation. Rising average living standards D. Management of the money supply.

Stagflation means that both the inflation and unemployment rate are rising. The inflation rate is decreasing and unemployment is rising. The Federal Open Market Committee promotes price stability and economic growth through.

Increasing inflation rate Question. Tindrae tindrae 04112017 Business High School answered The inflation rate is decreasing and unemployment is rising. When inflation rises the prices of goods and services go up making them more expensive.

Such a relationship between GDP and unemployment rates is important in two ways. The inflation rate is decreasing and unemployment. An increase in your nominal income and a decrease in your real income might occur simultaneously if.

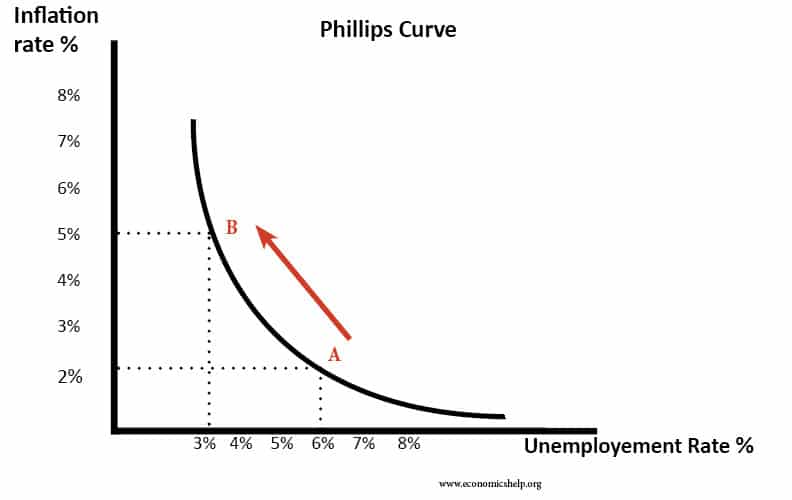

Graphically the short-run Phillips curve traces an L-shape when the unemployment rate is on the x-axis and the inflation rate is on the y-axis. GDP and unemployment rates usually go together because a decrease in the GDP is reflected in a decrease in the rate of employment. The slower growth will then lead to lower inflationEffect of raising interest rates.

As levels of unemployment decrease inflation increases. The relationship however is not linear. A rising GDP rising unemployment rate and rising inflation rate signify a healthy economy.

Decreasing interest rates E. A peak is when business activity reaches a temporary maximum unemployment is low inflation high. The relationship is negative and not linear.

User qa_get_logged_in_handle sort the inflation rate is decreasing and unemployment is rising. Which of the following circumstances usually accompanies a period of economic expansion. When the unemployment rate is high there are fewer workers.

Increased interest rates will help reduce the growth of aggregate demand in the economy. I nflation a nd unemploy ment ar e c losely related at least in the short-run. Conversely when inflation is falling and economic growth slowing central banks may lower interest rates to stimulate.

The economy is likely in. It can be shown by a graph as below. The rate of change of money wage rates can be explained by the level of unemployment and the rate of change of unemployment except in or immediately after those years in which there is a sufficiently rapid rise in import prices1.

Gross domestic product GDP is the measure of economic output by a country. Unemployment inflation and economic growth tend to change cyclically over time. A rise in employment levels is a natural result of increased GDP levels caused by an increase in consumer demands for goods and services.

Higher interest rates tend to moderate economic growth. Whereas with inflation the inflation rate is rising. Use this image to answer the following question.

The Phillips Curve In 1958 Phillips charted a negative relationship between wage inflation and unemployment based on 95 years of UK data. This means that when the inflation rate was increasing the unemployment rate should be decreasing. Appreciation of the domestic currency C.

Which of the following is the main result of long-term economic growth. The Central Bank usually increase interest rates when inflation is predicted to rise above their inflation target. You get decreasing inflation disinflation when the labour force is less than fully employed because the level of aggregate demand is not sufficient to match the output potential of the economy and this shortfall in demand relative to potential supply causes deflation by pushing down prices of goods and services or causes disinflation by pushing down the inflation rate of.

A difficult aspect of measuring the unemployment rate is the survey response rate is low. Decreasing unemployment rate O B. The sky-high rates will add about 400 to the monthly mortgage.

The four phases of the business cycle. Graphically when the unemployment rate is on the x-axis and the inflation rate is on the y-axis the short-run Phillips curve takes an L-shape. During a recession real GDP is decreasing the unemployment rate is increasing and the rate of inflation is decreasing.

The economy is likely in. Expans Get the answers you need now. The economy is likely in a.

0 Comments